Getting The Tulsa Bankruptcy Consultation To Work

Getting The Tulsa Bankruptcy Consultation To Work

Blog Article

Top Tulsa Bankruptcy Lawyers for Beginners

Table of ContentsBankruptcy Attorney Near Me Tulsa - The FactsGetting My Top-rated Bankruptcy Attorney Tulsa Ok To WorkGetting My Bankruptcy Attorney Tulsa To Work4 Easy Facts About Bankruptcy Law Firm Tulsa Ok ExplainedThe Ultimate Guide To Chapter 7 - Bankruptcy Basics

The statistics for the other main type, Chapter 13, are also worse for pro se filers. Suffice it to state, speak with a lawyer or two near you who's experienced with personal bankruptcy law.Several attorneys likewise offer free examinations or email Q&A s. Capitalize on that. (The charitable app Upsolve can assist you discover free assessments, sources and lawful aid at no cost.) Ask if bankruptcy is without a doubt the ideal choice for your situation and whether they think you'll qualify. Prior to you pay to file personal bankruptcy kinds and acne your credit history record for approximately one decade, examine to see if you have any kind of sensible options like financial obligation settlement or non-profit credit therapy.

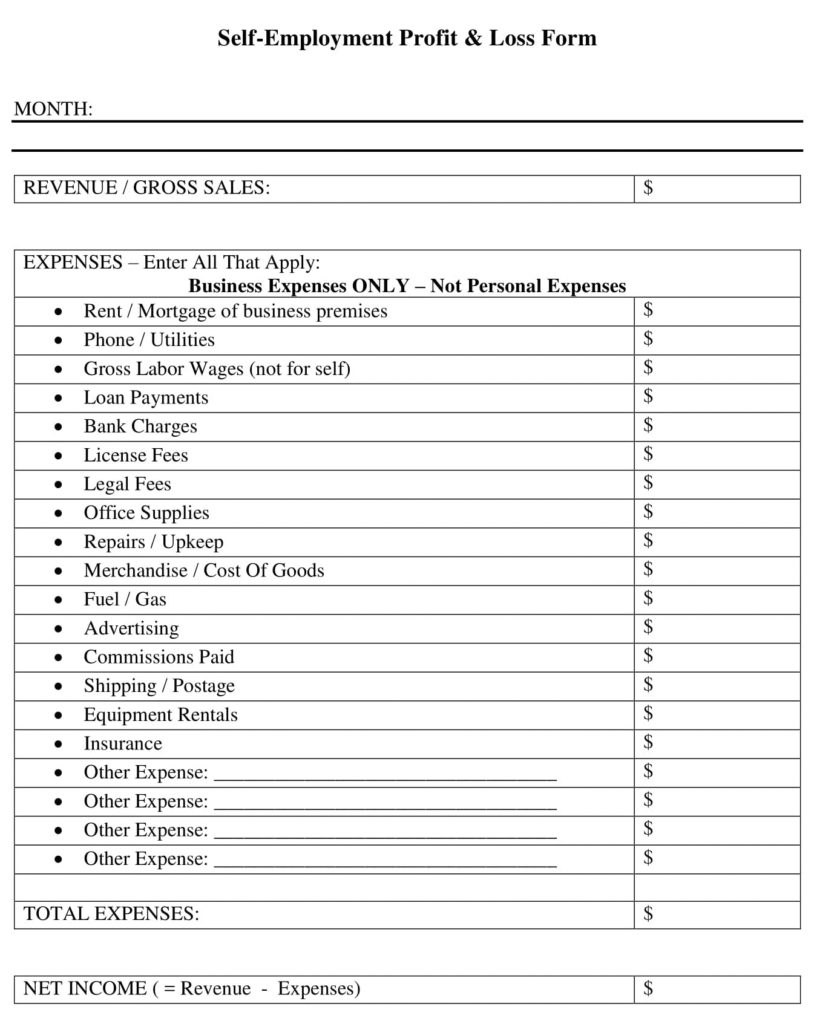

Ad Now that you have actually made a decision personal bankruptcy is certainly the right program of activity and you ideally cleared it with an attorney you'll need to get started on the documents. Prior to you dive right into all the main insolvency forms, you must get your very own papers in order.

What Does Tulsa Bankruptcy Consultation Mean?

Later down the line, you'll really need to prove that by disclosing all kinds of information regarding your monetary affairs. Below's a basic list of what you'll require when traveling in advance: Determining files like your motorist's permit and Social Safety card Tax returns (up to the past 4 years) Evidence of revenue (pay stubs, W-2s, freelance earnings, revenue from assets along with any revenue from federal government benefits) Financial institution declarations and/or pension statements Proof of value of your properties, such as lorry and actual estate assessment.

You'll want to comprehend what kind of financial obligation you're trying to deal with.

You'll want to comprehend what kind of financial obligation you're trying to deal with.If your income is too expensive, you have an additional alternative: Chapter 13. This choice takes longer to settle your debts since it needs a long-term repayment plan normally 3 to 5 years before some of your continuing to be financial obligations are cleaned away. The declaring procedure is also a lot more complicated than Chapter 7.

Tulsa Bankruptcy Filing Assistance Can Be Fun For Everyone

A Phase 7 insolvency stays on your credit history report for one decade, whereas a Phase 13 bankruptcy falls off after 7. Both have lasting effect on your credit report, and any kind of brand-new financial obligation you get will likely feature greater rate of interest. Prior to you submit your insolvency types, you have to initially complete a necessary training course from a credit therapy company that has actually been approved by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. You have to complete the course within 180 days of filing for insolvency.

The Greatest Guide To Tulsa Bankruptcy Legal Services

An attorney will commonly handle this for you. If you're filing on your own, know that there have to do with 90 different personal bankruptcy areas. Inspect that you're filing with the appropriate one based upon where you live. If your permanent house has actually relocated within 180 days of loading, you should submit in the area where you lived the higher section of that 180-day duration.

Generally, your personal bankruptcy attorney will certainly work with the trustee, but you may require to send out the person records such as pay stubs, income tax return, and savings account and bank card declarations straight. The trustee who was simply appointed to your instance will certainly soon establish an obligatory conference with you, recognized as the "341 conference" due to the fact that it's a demand of Section 341 of the U.S

You will need to offer a timely list of what qualifies as an exemption. Exemptions may use to non-luxury, key vehicles; necessary home goods; and home equity (though these exceptions regulations can differ widely by state). Any type of property outside the listing of exceptions is content considered nonexempt, and if you do not provide any kind of listing, after that all your residential property is thought about nonexempt, i.e.

You will need to offer a timely list of what qualifies as an exemption. Exemptions may use to non-luxury, key vehicles; necessary home goods; and home equity (though these exceptions regulations can differ widely by state). Any type of property outside the listing of exceptions is content considered nonexempt, and if you do not provide any kind of listing, after that all your residential property is thought about nonexempt, i.e.The trustee wouldn't sell your cars to quickly repay the creditor. Instead, you would pay your creditors that amount over the course of your layaway plan. A typical misunderstanding with insolvency is that as soon as you file, you can quit paying your financial debts. While insolvency can aid you erase most of your unprotected debts, such as past due medical costs or individual finances, you'll wish to maintain paying your month-to-month payments for safe financial debts if you wish to maintain the residential or commercial property.

The Ultimate Guide To Affordable Bankruptcy Lawyer Tulsa

If you go to danger of foreclosure and have worn down all various other financial-relief options, then applying for Phase 13 might postpone the foreclosure and assist in saving your home. Ultimately, you will certainly still need the earnings to continue making future home mortgage repayments, in addition to settling any late payments throughout your layaway plan.

The audit could postpone any type of financial obligation alleviation by several weeks. That you made it this far in the procedure Tulsa bankruptcy attorney is a decent indicator at the very least some of your financial obligations are qualified for discharge.

Report this page